Rolex Prices: A Closer Look at Trends and Why Waiting Might Cost You

Share

As someone who has spent over 16 years immersed in the fascinating world of luxury watches, I’ve had the privilege of witnessing Rolex’s unique market behaviour up close. Whether you're a seasoned collector or considering your first Rolex, the question often comes up: “Will Rolex prices go down?” It’s a valid concern, especially when these iconic timepieces represent not just luxury but an investment. To answer this question, let’s delve into the history, the market dynamics and most importantly, what this means for you.

A Brief History of Rolex Price Adjustments

Rolex has built a reputation not only for precision and craftsmanship but also for its meticulous control over supply and pricing. If you’ve been following the brand closely, you’ll know that Rolex tends to increase its prices annually, often by around 6% and sometimes even more. In recent years, this trend has evolved into biannual price adjustments, typically seen in January and later in the year around September.

For instance, since January 2022, Rolex adjusted its prices by an average of 6% in January, with some models experiencing steeper hikes. This was followed by another increase in September, reinforcing a pattern that’s hard to ignore. These adjustments are not random; they are deliberate and reflect Rolex’s strategy to preserve the brand's exclusivity, offset rising production costs and align with the increasing global demand.

What does this mean for potential buyers? Simply put, a Rolex purchased today is almost certain to cost more in the future.

The Factors Influencing Rolex Prices

Several factors drive Rolex pricing and understanding them helps shed light on whether prices might go down.

-

Supply and Demand

Rolex is famously meticulous about controlling its supply. Each watch is crafted with exceptional care, limiting how many reach the market. On the other side, demand continues to skyrocket, driven by a growing global appreciation for luxury watches and the rising number of affluent buyers. Scarcity only adds to the allure, making it unlikely that prices will drop. -

Resilience in Economic Uncertainty

Luxury goods, especially Rolex watches, tend to be resilient even in economic downturns. While some brands may discount their stock to encourage sales, Rolex maintains its value. In fact, during and since the COVID-19 pandemic, we saw a surge in Rolex demand, with pre-owned models often selling above retail prices. This resilience speaks volumes about the brand’s market positioning. -

Inflation and Rising Costs

Rolex is not immune to inflation and rising production costs. From sourcing premium materials to employing the finest watchmakers, every step of the process adds to the cost. These factors are inevitably passed on to the consumer, contributing to those regular price increases. -

The Pre-Owned Market

The pre-owned market for Rolex watches adds another layer to the discussion. Because Rolex timepieces often appreciate over time, models that are discontinued or in high demand see their values soar. This creates a perception, backed by reality, that buying a Rolex now is a sound financial decision.

So, Will Rolex Prices Go Down?

While no one can predict the future with absolute certainty, history strongly suggests that Rolex prices are more likely to rise than fall. The brand’s consistent price increases, coupled with its strategic control over supply, make it improbable that prices will decrease in any significant way.

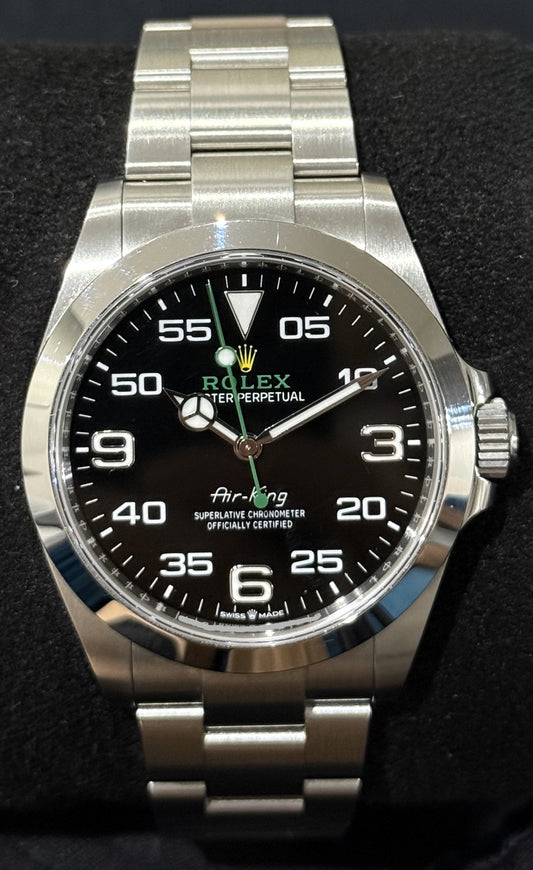

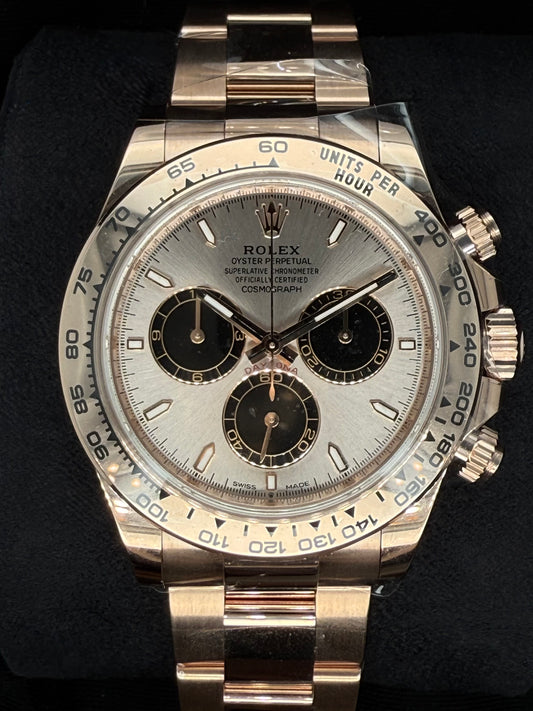

Even during periods of economic uncertainty, Rolex watches have maintained their value and in many cases appreciated. For instance, the coveted Submariner, Daytona and GMT-Master II models have all seen consistent value growth over the years.

Why Waiting May Cost You

If you’re considering a Rolex, the notion of waiting for prices to drop could end up costing you more in the long run. The biannual price adjustments mean that each delay potentially adds hundreds, if not thousands, to the cost of your desired model.

From a collector’s perspective, there’s also the opportunity cost to consider. Rolex watches are not just timepieces—they’re assets. Many models appreciate over time, meaning that the earlier you buy, the sooner you can benefit from potential value growth.

Why Now Is the Perfect Time to Buy

At The Watch Co Australia, we’ve seen first-hand how Rolex watches transform from luxury purchases into treasured investments. Owning a Rolex isn’t just about keeping time, it’s about owning a piece of horological history, a symbol of achievement and a financial asset that stands the test of time.

With the current trends in the market, there’s never been a better time to invest in a Rolex. Whether you’re drawn to the iconic Submariner, the classic Datejust or the adventurous Explorer, each piece carries with it the promise of enduring value.

Plus, with our loyalty program, your purchase becomes even more rewarding. Every Rolex you buy earns you points that can be redeemed for future purchases, making your journey into luxury watch ownership even more exciting.

Final Thoughts

While the question “Will Rolex prices go down?” is understandable, the evidence overwhelmingly points to continued price increases. History, market dynamics and the brand’s unparalleled reputation all suggest that investing in a Rolex now is a smart decision.

As a watch expert and enthusiast, I’ve always believed that a Rolex isn’t just a purchase—it’s a commitment to quality, style and timeless value. At The Watch Co Australia, we’re here to guide you on that journey. So why wait? Explore our collection today.