The Vanishing Act: Why Luxury Brands Are Producing Fewer Stainless Steel Watches

Share

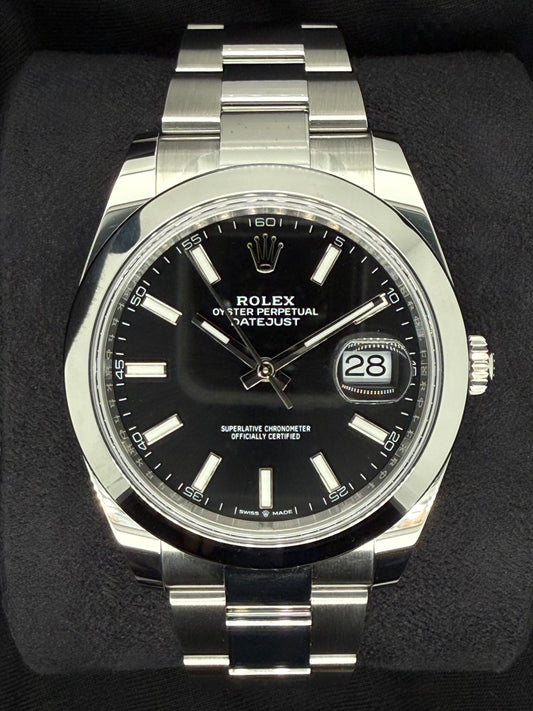

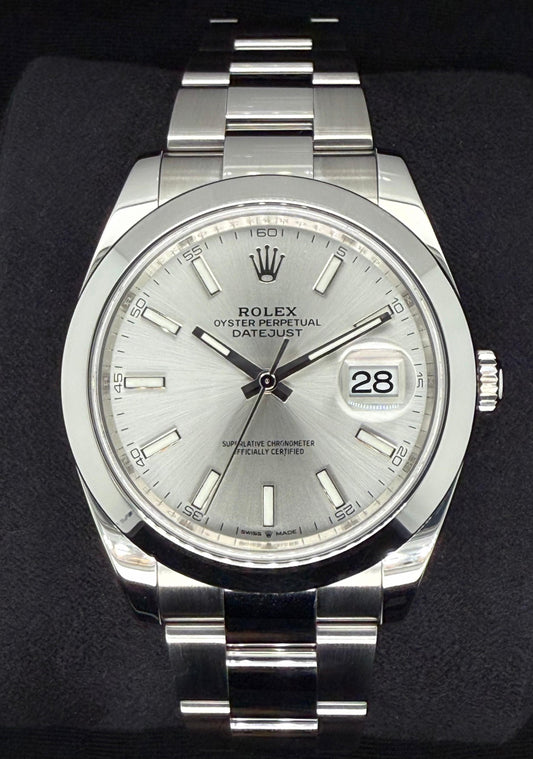

For years, stainless steel watches have been a staple in the luxury watch world, offering a perfect balance of prestige, durability, and versatility. Models like the Rolex Submariner, Rolex Daytona and Patek Philippe Nautilus have long been among the most desirable timepieces in stainless steel, often with waiting lists stretching years. However, an undeniable shift is taking place—major brands are cutting back on stainless steel production, making these watches harder to obtain than ever before.

So why are brands like Rolex and Patek Philippe reducing their stainless steel offerings? The answer lies in exclusivity, profitability and brand strategy.

Same Craftsmanship, Less Profit

One of the biggest reasons behind this shift is profitability. While stainless steel watches may be the most in-demand, they require the same meticulous craftsmanship, development and production time as their precious metal counterparts—yet they generate significantly less profit for the brands.

A Rolex Daytona in gold or stainless steel both go through the same rigorous quality control, movement finishing and assembly process. The difference? The profit margin on the gold watch is significantly higher due to the material cost. The actual labour, research, and precision engineering that go into both watches are nearly identical, yet brands make a fraction of the profit on stainless steel models.

From a business standpoint, it makes sense for luxury watchmakers to shift focus toward higher-margin precious metal watches while keeping steel models more limited to maintain exclusivity and desirability.

Discontinued Stainless Steel Icons

The trend of reducing stainless steel models is already evident in recent discontinuations. Patek Philippe shocked the market by discontinuing the Nautilus 5711, one of the most sought-after steel watches of all time. Rolex has also phased out certain configurations, including the Oyster Perpetual 41mm in Tiffany Blue, the Air-King, and the Milgauss.

This reduction in supply only makes existing steel models more desirable—driving up secondary market prices and making these watches even more of an investment piece.

How This Affects the Secondary Market

With fewer stainless steel models being produced, demand is rapidly outpacing supply. The secondary market has already seen dramatic price increases, particularly for discontinued models.

Take the Patek Philippe Nautilus 5711—before it was discontinued, it retailed for around $50,000 AUD. Within months, prices on the secondary market soared past $200,000 AUD, and even the final green-dial edition reached an astonishing $750,000 AUD at auction.

Similarly, stainless steel Rolex models like the Daytona and Submariner continue to sell well above retail, with waiting lists at authorised dealers stretching indefinitely. As fewer stainless steel models are made, these watches will only become harder to obtain, making them even more valuable to collectors.

Now Is the Time to Buy

With luxury brands deliberately cutting back on stainless steel production, waiting could mean missing out—either due to skyrocketing prices or complete unavailability.

If you’ve been considering adding a stainless steel Rolex or Patek Philippe to your collection, now is the time. These watches are already among the most iconic, timeless, and investment-worthy pieces in the industry, and their reduced production will only make them more desirable in the future.

At The Watch Co Australia, we have a carefully curated selection of highly sought-after stainless steel models available now. Given the direction the industry is heading, these won’t last long.